Let’s be honest, most people, especially those living in first-world countries, are very demanding today. With Amazon shipping packages before clients even purchase them and Spotify making playlists based on the listener’s taste, it’s really hard not to get spoiled.

Banking is not an exception. Most customers are tired of waiting in line in the banks and feel a little bit depressed, when they fail to find a branch nearby. Neobanks were created to make sure people never have to deal with such problems. Convenience, speed, and low costs are the words that best describe these fintech disruptors.

If you’re considering building a neobank, JatApp has prepared an article for you to explore its benefits, business models, opportunities, and key challenges. So, let’s begin with a neobank definition, shall we?

What is a neobank?

Neobanks are the banks that don’t have any physical branches and function purely online. They offer digital solutions for money transfers, payments, lending, to name a few. Neobanks rely on state-of-the-art technologies, such as artificial intelligence (AI), to deliver personalized banking services to their customers. Since they don’t have physical bank locations that require maintenance, they don’t charge large fees from their clients.

To better understand the difference between neobanks and traditional banks, please, take a look at the comparison table below.

Well, at this moment you might say that the difference between traditional banks and neobanks is quite obvious. But what about digital banking? Are neobanks and online banks the same thing? The short answer is no. A digital bank refers to an online-only arm or extension of a traditional bank.

Neobank features that differentiate them from traditional banks

Neobanks are small kids with cool toys, while traditional banks are parents with solid experience behind their backs and conventional values. In other words, neobanks offer a range of cutting-edge and innovative features that traditional banks are sadly lacking, despite their profound experience. Let’s take a look at some of them.

Digital Know Your Customer (KYC)

Neobanks validate users’ identity and other documents remotely. Such services as Onfiod, Jumio, and Troolio, help confirm the data by not only processing unique numbers, but also using such databases as Politically Exposed Person (PEP), lists of cybercriminals, sanction lists, and similar. At this stage, the neobank decides whether to deal with a person or not. In case verification has been disrupted for some reason, the compliance team may reach out to the client and ask for additional user data.

Biometric authentication

Imagine you walk through supermarket aisles to fill your grocery bucket with different goodies. Happy and satisfied, you’re heading towards the cashier, once you’re done shopping. When you’re passing your card to make a payment, you suddenly realize that you have absolutely no idea what your PIN-code is…

Sounds familiar? Statistically, four out of five people have forgotten their passwords during the last three months. Of course, if you’re not a big fan of 1234 or qwerty as passwords, you probably enjoy much biometric authentication. Neobanks have biometrics, like fingerprint or facial recognition, as one of authentication layers. It is a very convenient and fast way for end-users to perform different operations in their mobile app. The login remains one of the most common uses of biometric authentication. However, many banks also rely on this technology for transaction confirmation and document signing.

Biometric authentication in neobanks

Online lending

Neobank users can easily apply for loans online and understand algorithms behind lending programs. Most traditional banks rely on credit based scoring models to decide whether a client is able to repay a loan. Instead of using this scoring model, neobanks implement “enrollment analysis” of digital data to get a clear picture of a person’s financial health.

Neobanks analyze the client’s spending habits and receipts to understand what kind of loan they can qualify for. This procedure is especially useful for unbanked and underbanked people that have little to no access to traditional banking services, which, by the way, makes up 18% of the population in the United States.

Gamification

Gamification is another distinctive feature of neobanks, which helps users to never get bored with customer services. Gamified icons, for example, let users customize their accounts to visualize their personal notes or mark their receipts. Writing a real notice is often time-consuming, while adding a “car” icon to their receipt related to the transportation costs or a “kid” icon to the receipts on the expenses spent on children will help users navigate better through banking messages without wasting much time.

Another gamification element is creating a digital hero around your solution, whether it’s a small birdie or a honeybee. Building such a character as a cute bear helped a Korean-based neobank, Kakao Bank, increase brand awareness and attract lots of users’ attention.

Kakao Bank gamification elements

What drives the popularity of neobanks?

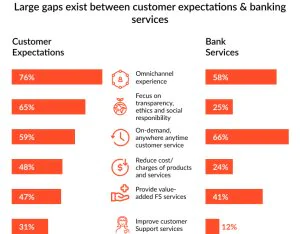

During the pandemic, traditional banks failed to transform their offline services to digital ones. The World Banking Report 2021 suggests that 46% of bank executives said that they lacked the expertise to become a truly data-driven company. Many customers felt that traditional banks could have performed better, given the abundant resources in their disposal.

Naturally, clients started to prefer fintech solutions more, which allowed them to perform all banking operations in one place without leaving the comfort of their homes. The disparity between banking services offered by traditional banks and clients’ expectations increased over time, giving neobanks a competitive edge.

Gap between traditional banking and customers’ expectations

How do neobanks make money?

Today, there are five business models that modern neobanks adopt to stay profitable.

- Interchange-led

Banks charge a commission everytime a client makes a transaction. An infamous American neobank, Chime, is known for adopting this business model.

- Credit-led

With this model, a neobank relies on credits as the source of its revenue. The profit is generated from balances and their interest rates. Nubank is an example of neobanks with a credit-led model.

- Ecosystem-led

Under the ecosystem-led model, banks earn money with the help of the application programming interface (API) technology that lets various fintech solutions integrate in. A popular neobank, N26, gets juicy profits using the ecosystem-led approach.

- Asset-led

Neobanks benefit from offering savings accounts and purchasing deposits with competitive rates. Aspiration Bank epitomizes an asset-led bank based in the United States.

- Product extension

As the name suggests, this business model focuses on generating revenues from extending the existing product. A couple of years ago, Robinhood introduced a product extension called Robinhood Gold, which provides clients with comprehensive market analysis. The subscription-based model along with this service enables the neobank to secure its position in the fintech market.

Key challenges that neobanks are facing today

Looking underneath the hood of main challenges reveals that it takes much effort for entrepreneurs to get a banking license. Even when they manage to get one, they’re still facing the clients’ distrust.

Getting a banking license is both complex and costly

Applying for a license is no easy feat for neobanks, as it may take much time and require a lot of financial resources. On a bright side, this allows banks to offer a greater variety of services: prepaid, credit or debit cards, cryptocurrency, peer-to-peer payments, currency exchanges, loans, checking and savings accounts, and so on. Revolut, Monzo, and N26 are some of the banks that went through all the bureaucratic hell to get the banking license.

Monzo app functionality

If you’re not ready to sign up for such an adventure, you can affiliate with another licensed bank. Your clients may have an account at the licensed bank, which would be connected to your neobank services, such as money management, transaction analytics, assistance in attaining financial goals, to name a few. Chime and Yolt are some of the most popular neobanks that decided to go down this road.

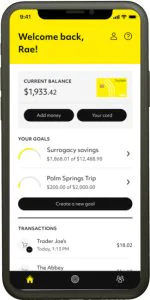

An example of Chime app functionality

Customers aren’t using neobanks as their primary accounts

Traditional banks can boast of many years of experience under their belt. This can make them look more reliable in the customers’ eyes compared to the new market movers, like neobanks. In fact, most users have primary accounts in traditional banks, as they need some time to experience neobank services in order to build trust. Since people are inherently resistant to change, many neobanks continue to face low average deposits and revenue rates. To win this fierce banking battle, they need to focus on their strengths, such as personalized services and lower costs.

Alluring opportunities to consider

It’s super important to understand business opportunities to deliver a product that customers would really love. Check out some of them to ensure your neobank is both relevant and up-to-date.

Targeting the underserved markets

Neobanks should target niche markets that traditional banks have long ignored. Addressing pain points of these poorly served segments will help not only improve customer banking experience, but also grow client-friendly reputation. By solving unique problems of smaller segments, neobanks provide their customers with the value they would be highly willing to pay for.

Daylight is an LGBTQ+-friendly neobank that managed to close a $15 million Series A round. The bank is organized around an inspirational mission to improve the lives of queer people. Its clients not only enjoy free automated teller machines (ATMs) and ability to get paid 48 hours earlier, but also the opportunity to ask questions related to “LGBTQ+ financial literacy”, like family planning. Daylight strives to help queer people address both financial and legal challenges that they inevitably face when starting a family.

Daylight banking services for starting a family

Let us give you some background. LGBTQ+ community members often have to deal with discrimination in traditional banks. One of the recent studies suggests queer people are 73% more likely to be either approved for a mortgage with the interest rate higher than average, or denied a mortgage at all. Daylight was launched to change that by allowing its users to take family-building loans.

Daylight app functionality

Hyper-personalization

Dale Carnegie in his bestselling book How to Win Friends and Influence People recommends its readers to call everyone by their names, claiming that it’s the sweetest sound for them. Remembering names is one of personalization strategies that makes an individual feel important and valued. Perhaps, most neobank creators are familiar with this piece of advice, as they take personalization rather seriously, when it comes to banking services.

With cutting-edge technologies, such as AI, banks offer a variety of hyper-personalized services that help users meet their unique needs. Mitto is a Spanish neobank that combines hyper-personalization with the socially responsible mission to promote conscious spending. The bank shows users the carbon footprint impact of their buyings and compares it with that of their friends. When users are 100% aware of the impact of each transaction, they’re more likely to nudge to environmentally-friendly behaviors. What is also important is that the neobank offers discounts on sustainable brands that users might be interested in.

Mitto neobank

In neobanks we trust

Neobanks have completely changed financial services, as well as the speed at which they are provided. The neobank market is expected to grow in future, with more personalized offerings designed for new niches. In such a way, neobanks are becoming more client-oriented fintech players, targeting populations who need them most. However, the true success driver is that they are ensuring easier access to banking services at lower costs.

If you need a software company to build your neobank, look no further. JatApp has more than seven years of experience in developing solutions for the fintech industry. Since getting a license may be rather costly, you’ll be delighted to know that with us you can cut down your development expenses by up to 60%, compared to the Western markets. Besides, we guarantee you a high-quality fintech product aligned with all industry regulations. Our software engineers rely on data encryption standards and secure coding practices to prevent cyberattacks and protect user data.

Want to cooperate with JatApp? Leave us a note and we’ll talk to you soon.