Charles Joughin was a chef baker at the unlucky Titanic. The day the ship tragically hit the iceberg, Charles was helping women, children, and elderly people get on lifeboats that arrived to rescue the Titanic’s passengers. Realizing that there was no space in lifeboats left for him, he went to the abandoned bar on the ship’s deck and drank half of a liqueur’s bottle to make his inevitable death less painful.

Drunk as a skunk, Charles jumped into freezing water… and kept swimming for two hours until one of the lifeboats picked him up as there was enough space on it. Charles did not even catch cold or any other kind of illness, all because of alcohol that kept him warm.

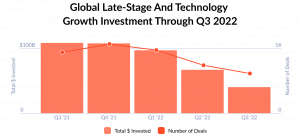

The fintech market now resembles freezing waters Charles had to jump into, as the industry tends to “cool down” in terms of investment compared to the last year. According to the Crunchbase report, venture capital funding decreased by 53% in the third quarter of 2022 in comparison with the same period in 2021. Starting a fintech company today is risky, but that’s the reason why entrepreneurs do this: the reward for taking a risk is impressively high.

JatApp has been developing fintech products since 2015 and we always welcome entrepreneurs who are not afraid of challenges on their way to visionary digital solutions. For that reason, we have prepared our guide on how to create a fintech startup and jump into the dark cold waters of market competition.

Ways to keep your fintech product a hot offer

A significant pullback of venture capital funding in the financial technology sector is the main reason why starting a fintech business may be a risky decision. The global whiplash of capital investment stems from post-coronavirus crisis and growing inflation. As a result, numerous fintech startups didn’t live up to their promise of profitability.

Customers still have a little trust in fintech startups that don’t provide enough personalized and affordable services because incumbent financial institutions don’t standby and watch how fintechs try to bite a huge size of their revenue pie. Conventional banks and other financial companies digitalize their services, outcompeting fintechs that don’t have much resources to create a reliable financial infrastructure.

These factors make any fintech startup a risky business, which is why we keep mumbling our mantra in every fintech-related article: a rare fintech startup becomes profitable fast, so be ready for a long journey. That is why the following recommendations on how to start a fintech company today also grow from the “aim high, take small steps” mentality.

Find an underserved market

Incumbent banks and other financial institutions target a general market of customers, while many groups remain underserved, such as small businesses, young people, freelancers, vulnerable populations, and so on. You need to find a narrow-specific group of customers which your fintech product is going to serve, otherwise you’ll have to engage in a competition with big incumbents that have enough resources to make your startup drown very fast.

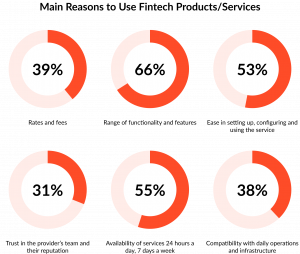

As soon as you identify your target market, you need to study what your customers really need. Far too many fintech companies make solutions in search of problems, and then naturally fail. We just want to say that you shouldn’t invest in development of any services and core features without knowing exactly what problems and pain points your target audience has.

You should remember that users are likely to come to your product because they find that traditional banks and financial services are missing the mark of personalization, inclusivity, and customer experiences. When you have the key problems identified, you need to think about financial access, affordability, and tangible rewards your fintech can bring to the table.

For example, imagine you are going to develop a loan app for university students. In this case, financial access means that the credit scoring system has to be simplified with respect to the fact that your users are students and may not have any credit history at all. Affordability, in turn, means that interest rates are feasible for timely payout by a student, otherwise you’ll face a high delinquency and user churn rates. Finally, reward your customers for choosing you: cashback bonuses or discounts on partner products and services are the most typical ways to praise your users for being loyal customers.

Build a lean minimum viable product (MVP)

Since the stream of investments in the fintech sector is freezing, melting the cold hearts of venture capital funders is another challenge you have to cope with. And nothing works better than impressing investors with a working product that customers can use right here right now.

Here we mean that you should build a minimum viable product. While you’re thinking about what you are going to do next, your product is offering a meaningful core solution to your customers.

But you should not develop MVP of your fintech app just to survive through the next funding round. The purpose of your MVP is to state that you’re a healthy competitor ready for long and tiresome rivalry — that’s what investors want to see from your company.

As you need to create a simple, yet valuable solution ready to hit the market, we suggest you focusing your development efforts on such basic fintech features as:

- Security

- Debit card issuing

- Account balance and spending behavior analytics

- Money transfer to friends and relatives

- Integration with third-party services

- Apple Pay and Google Wallet compatibility

- Bonuses and rewards

- Protection from card overdraft

As soon as you celebrate a positive feedback of your early customers, you can pivot your fintech app development towards one of the product types you can see in the image below:

Reinforce efforts towards customer acquisition strategy

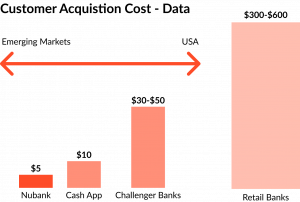

Instead of shelling out a many-digits amount of money at marketing your product, we suggest you direct your efforts on building a solid customer acquisition strategy. The matter is that customer acquisition cost (CAC) for fintechs is much lower in comparison to incumbent financial services. Mainstream banks and large financial enterprises spend within 50$ to 200$ on acquiring one customer, while fintechs can do well in the 5$ to 10$ range.

You can optimize your CAC expenses by targeting an underserved customer segment. We’ve talked about it before, and now we just want to highlight that knowing the problems of your customers will help you acquire and retain them without splashing out on extravagant marketing campaigns.

On top of that, an effective customer acquisition strategy should include a sharp focus on front-end development of your product and full-fledged core banking infrastructure. Clunky user interface/user experience (UI/UX) design and inability to perform basic financial transactions can seriously discourage your customers from using your services and eventually make them abandon your product.

Keep your business model and revenue streams flexible

Fintechs don’t reach the profitability threshold because there are many pitfalls on their way, which means you need to tweak your business model literally on the go. Delinquency costs, interest rates too high or too low, an ill-equipped underwriting process, poor ecosystem of services, and similar reasons will force you to continuously amend your business model.

But how do you notice those red flags? Customer feedback is your reliable compass in the murky waters of the fintech industry ocean. When you have your MVP ready, make sure you have channels and tools to collect feedback from your early users to adjust your profit-making mechanism with maximal agility to keep your startup afloat.

In the same vein, you shouldn’t rely on a single revenue stream. Even the biggest players like Chime expand their ecosystem of services, despite the fact that they excelled as one of the major neobanks. If you have resources to run interchange, lendings, bank account savings, or any other services at the same time, your business will more likely survive and sail to the land of profitability.

Ways you can diversify your revenue streams

Establish a robust infrastructure

Since you’re going to build a fintech product at such a stormy period for the entire industry, building your homegrown core banking infrastructure is out of the question. Actually, it’s out of the question under any circumstances. Custom digital banking infrastructure is immensely expensive, insanely complicated in terms of architecture, and taking ages to develop.

Instead, you need to use a banking-as-a-service (BaaS) platform — the other mantra we like to mumble in every blog post about fintech. Call your pet a BaaS or change your mom’s contact name in your phone, write the BaaS acronym on the ceiling of your bedroom with huge block letters — do anything to remember that banking-as-a-service is your most affordable and reliable way to embed a core banking infrastructure in your fintech product.

To provide core banking services without facing enormous resource expenses you need a banking-as-a-service platform. Period.

JatApp will share with you the warmth of our hearts and develop quality fintech product

Charles Joughin acted desperately because he didn’t have much of a choice in front of the death howling with ocean winds around a poor Titanic. You are brave enough to start a fintech startup today, but desperation is the last thing you need.

Instead, you need a reliable tech provider that will take care of software development for you, so you’ll be able to focus on ideating the growth strategy for your business. JatApp has developed many fintech products such as payroll system, bill splitting app, and payment gateway. We are proud to admit that 99% of our customers leave positive feedback on the products we delivered them.

Make your fintech startup a hot offer by leaving us a note. It’s fine if you don’t have any clear idea in mind, we’ll contact you and share with you our vision of how to start your own fintech company.