Breaking news! The recent funding round led a global payroll startup Deel to its valuation increase up to an impressive $12 billion. The founders knew that they were going for big wins when they decided to aim their business at global expansion.

Payouts tab in Deel

However, the startup has to compete with only several rivals today. This state of affairs sheds light on two things: the payroll software industry is full of opportunities, and these opportunities will be tapped very quickly. Allied Market Research reports that the managed payroll systems market will grow to $10.33 billion by 2023, so thinking about how to develop payroll software fast enough bothers not only you, but many other entrepreneurs as well.

For that reason, the JatApp team will guide you how to develop payroll software that will conquer the market without having competitors hot on the heels of your business.

What users expect

For starters, let’s clearly define what payroll software is. Payroll software is a digital solution aimed at management of various accounting and human resource issues related to remote employees, such as salary payouts, tax deductions, employee benefits, compliance with legal regulations, and so on.

When companies think about adopting payroll software for their remote teams, they expect a solution that helps to manage wages, taxes, insurance, paid leaves and such as well as keep all these processes within legal boundaries of an employee’s location country. In other words, payroll software should enable remote employees to feel just like in-office employees, thereby promoting stronger commitment and retention.

Needless to say, there are several problems and pain points that employers have behind their backs, because of which they’d love to have useful payroll software. That’s why you need to build your payroll system according to the following principles that reflect on the above mentioned challenges companies face when hire remote teams:

- Data security. Beyond all doubts, data is the core of the payroll process. Apart from data-focused architecture and design of a payroll system, you need to take care of security. You have to be sure that employees’ personal information won’t get leaked and used by hackers under any circumstances.

- Scalability. We highly recommend you to keep the idea of scaling your product in mind even when it’s not deployed yet and avoid building your payroll software with a monolithic architecture. When the time comes to scale the solution, you’ll have to refactor the entire software. It’s definitely better to develop the app with microservice architecture from the very start.

Monolithic vs microservices

- Integration friendliness. Many of your customers would like to integrate the payroll software with their current human resource management system, which is why your product must offer such an option. Otherwise, inability to integrate your solution with a client’s platform can be a potential deal-breaker. In addition, having your payroll software easy to integrate into other products creates more opportunities for partnership with similar businesses that may want to have your solution as a part of their services.

- Legal compliance. This aspect is as important as payroll data security because it won’t make sense to build a payroll app if it doesn’t enable a company to cope with labor and tax laws in multiple countries. We won’t be diving into this void here, since there are many details to cover that are worth a separate article, but make sure you did good research in this regard before launching your product.

What about features?

Since we’re talking about how to develop a payroll software that will jump into the market as fast as possible, here is a list of features that can present a good minimal viable product (MVP) of your payroll app:

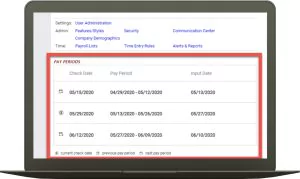

- Salary payout schedule. Employees simply need to know when their pay period comes, and how often it’s paid: weekly, every two weeks, or monthly. In the same vein, it’s crucial that employees can view their salary for a selected period and read annual statements to be able to evaluate their current financial status.

- Attendance and leave. It’s difficult to remember and record how many paid days-off an employee had. That’s why counting working hours and calculating leave payouts are also necessary to avoid any confusions that can significantly spoil an employee’s experience of working remotely with a client’s company.

- Overtime dues and reimbursement claims. It’s essential to enable companies to track any cases of overtime work and cover other expenses like employee insurance. Reimbursement of health insurance can get overwhelmingly complicated, so your software product should help employers manage all this bureaucratic hell.

- Bonuses. Even if a company offers plain salary bonuses, both employee and employer need to clearly understand how these bonuses are awarded. Consequently, a relatable feature is a must for your payroll management solution.

- Pay raises. This feature can be optional, as some companies may prefer not to announce any salary reviews beforehand. Still, if you decide to add this feature, your customers may thank you for it. The feature can additionally motivate the staff as they will see an extra reason to push themselves hard at the workplace.

- Wage deductions and tax filings. Employees need to know whether they have any penalties and what tax deductions they can expect with the following salary. The JatApp team included such a feature in a payroll application developed for our German client. As a result, the app users can track all financial records and download the relatable reports if necessary.

- Employee guide. Finance and accounting are fairly complicated things to comprehend, especially after a hard working day. That is why it would be nice if your payroll system includes some kind of guide or tutorial section, where an employee can learn how the entire payroll process works and why their company pulls their purse strings in one way or another.

And of course you can drive all these features with artificial intelligence to make an automated payroll system. Nevertheless, you need to be aware of additional legal regulations that may come into play. Payroll software is both a human resource solution and fintech rolled into one, which is why many relatable regulations should apply.

Anyways, you’re definitely curious about the time and cost you need for developing a payroll software. From our experience, it takes approximately three months to develop a solid MVP, while the payroll software cost starts from $40,000. Time and cost can vary depending on multiple factors, but if you assume the numbers we’ve just mentioned, you’ll be well-prepared to start the project.

When your product enters the market: what’s the next step?

While the features we’ve discussed above are just fine to enter the market, it’s reasonable to consider scaling your business in the near future. There are several ways payroll systems can grow: expansion to other countries, inclusion of additional services like bank loans, contractor payouts, management of visa/relocation matters, and integration with human resource platforms.

To be more specific, integrations with big human resource management platforms will be the most fruitful direction for growth today. A co-founder and CEO of Symmetrical.ai, Piotr Smoleń, told TechCrunch: “We believe that 10 years from now, ‘payroll software’ will be eliminated from the dictionaries and payroll will work invisibly as a part of broader platforms”.

Smoleń’s statement certainly holds true, as seven out of ten global companies use platform-based business models. All-in-one solutions are bursting into the global market, and it’s apparent that big players won’t be able to have all services in place within a short period. That’s the time you can appear and politely offer your solution with an open application programming interface (API) to integrate it into a large human resource management platform.

Symmetrical.ai API

Sure, all popularity will go to the platform’s owner, but does it matter when you know that your own business grows, and payroll system development earns you a lot of money?

The latter paragraph was meant to end the subject of directions you can take to grow your payroll software business. While we were preparing this article, JatApp’s COO came up with a thought: “If a remote employee stays somewhere abroad for long, they usually have to pay taxes in this country. This information should be reported to the state where an employee has official citizenship. Is this process streamlined enough? I am not sure it is.”

The COVID-19 restrictions are not much of a roadblock for 35 million of digital nomads worldwide who evidently travel a lot. Although, staying over a particular number of days can mean that an employee is obliged to pay and report local taxes on the income they earn while working in the country. At the same time, they need to report these taxes to the state where they have citizenship.

Employment status trends

Many countries agree to exchange such reports, but it doesn’t necessarily mean that this process is plain and convenient. Since a gap exists, you can fill it in with your extended payroll management solution.

Partnering with governments can be tough, but many states are ready to throw money at you just to make you come and resolve the problem for them. For now, global digital transformation spending is already $1.8 trillion, which means that there will be enough money to fund your project if you venture to offer a digital solution for a seamless foreing tax reporting.

You can see that the payroll software market is extremely disruptive, and ideas for growth appear unexpectedly. You can try out any of your own ideas, and there are high chances that it will find its target audience.

JatApp will help you bring your product to the market first

Don’t think we want you to put the cart before the horse and make a rush decision about starting a payroll software project, but the opportunity to hit the market won’t last for long as new startups arise at a supersonic speed.

Instead, JatApp offers you professional assistance in developing software products for HR and recruitment. By cooperating with us, you can build a top-level payroll management application fast enough to harness the current market opportunities. You’ll be able to scale up/down your tech team depending on the business needs, as you’ll have access to the pool of the best engineers in Eastern Europe.

Just get in touch with us, and we’ll start our collaboration at your earliest convenience.