“Sell me this pen” is the phrase that Jordan Belfort, also known as the guy from The Wolf of Wall Street played by Leonardo DiCaprio used to say when he was interviewing candidates for the job of stockbrokers. Today, stock trading apps automate brokers’ selling function, acting as an intermediary between the stock market and investors. To sell a pen (to be more precise, a stock), trading startups need to offer users features like real-time analytics, that would convince even the most skeptical user to make an investment.

As you may have guessed, stock trading app development is not an easy job. Apart from plotting how to make a user buy a stock, you need to think of ways to turn as many people as possible into budding investors. In fact, the reason most people don’t engage in the stock market is the lack of financial literacy rather than high commission fees. Therefore, your application has to educate people as well. The JatApp team would like to share tips and tricks on how to create a trading app that helps investors make money work for them.

The stock trading app market is soaring, and here’s why

The stock trading app market has seen a big comeback during the Covid pandemic. People stuck at home were actively trading shares using their smartphones. Many of the stock trading solutions didn’t have any commission fees, which further contributed to the spike in the number of users.

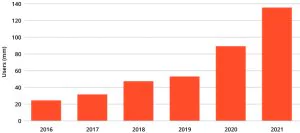

Stock trading annual app users 2016-2021

Another evidence showing the exponential growth is the increase in app revenues by 49% from 2020 to 2021. Let’s take a look at how the stock trading annual app revenues skyrocketed from 2016 to 2021.

Stock trading annual app revenues 2016-2021

The rise of meme stocks is another factor that drives the stock trading market. Meme stocks refer to hyped stocks on Twitter or Reddit that perform well for God knows what reason. Clout chasers promote these on social media in hopes of them growing in value and getting rich.

Born of quarantine boredom, meme stocks were initially perceived as a flash-in-the-pan trend. Today, Wall Street experts seem not so skeptical, predicting that meme stocks will stick around, boosting the market revenues.

How does a stock trading app work?

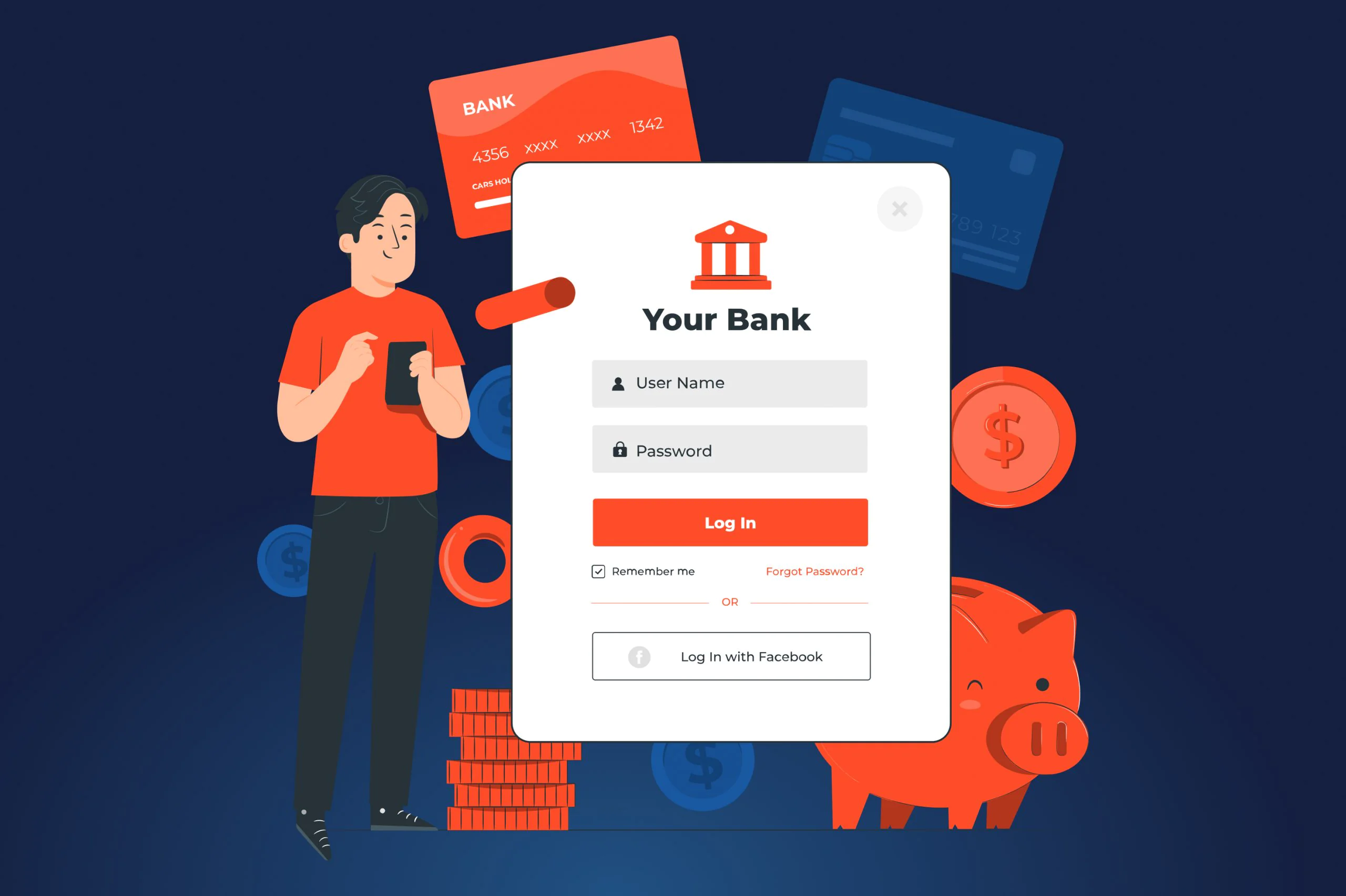

Stock trading applications let users place funds by sending their money manually or connecting their bank account to the platform. These apps are basically the marketplaces that connect investors to major exchanges.

It’s worth noting that the buying process doesn’t occur in real-time. The application sends the user’s order to the exchange and then searches for someone who wants to sell that stock. The transaction may take hours or days, especially if the volume of the asset is quite large.

There are two major types of exchanges: crypto exchanges and traditional exchanges. Trading applications that connect users to the former allow buying and selling crypto currencies, like Bitcoin or Ethereum. Solutions that are linked to the latter enable investors to purchase shares of public companies. Whenever they have a successful transaction, the marketplace gets a fee for it.

An example of a platform connected to crypto exchanges

The financial asset or money from the transaction is then sent to the user’s portfolio. Investors can withdraw their money, when convenient.

The most trending features to add

Having discussed the user’s flow in a nutshell, now you know the basic features of a stock trading app. Many FinTech startups deliver added features, like news feed, social trading, real-time analytics, and fractional shares to set themselves apart from others in their niche.

News feed

Needless to say, investors usually conduct comprehensive research to decide whether they pour their money in a stock or not. That’s why they need to know the stock’s financial standing, its past performance as well as major events happening in the financial world.

Offering news that might affect the stock performance is both useful and convenient for investors, as in this case they would no longer need to leave your app to search relevant information on other websites. Some solutions, like Capital.com, provide users with news not only about trading stocks, but also about cryptocurrencies, economics, and commodities, too.

Capital.com news feed feature

Social feature

Many startups started to add a social twist to stock trading by imitating social networks, like Facebook or Twitter. For example, apps like Shares offer users not only an interface to buy and sell shares, but also exciting features that allow them to chit-chat with friends, check out their activities, and learn from the trading experience of fellow investors. The most intriguing functionality, however, is the ability to build group stock indexes with friends.

Shares social feature

Real-time analytics

Real-time reports and charts help investors better understand the trading market and spot patterns. Take Navexa, for example. Its solution enables users to have a bird’s eye view of their portfolio, showing the total net worth of their holdings and their return on investments. You may also add such metrics as portfolio diversity, price change sensitivity, profit and loss, and so on.

Navexa analytics page

Fractional shares

A fractional share is when an investor owns less than one share of a public company. Fractional shares let users invest in dollars, so that they may end up owing a whole share, multiple shares, or only a fraction of a share.

Coming back to Shares, the startup provides investors with no-fee access to its platform. Moreover, users are able to start investing with as little as £1.00. Such a low entry barrier makes stock trading especially appealing to first-time investors.

Shares app functionality

Top trading apps and their business models

Robinhood

Robinhood is the leading fractional shares trading platform that charges no fees for purchasing stocks and cryptocurrency. The company makes money by offering clients an upgrade named Robinhood Gold, which costs $5 a month. This premium service provides investors with market data from Nasdaq, detailed research reports from Morningstar, the ability to borrow to invest on margin, as well as $5,000 in deposits, which lets them quickly access their money.

Robinhood app functionality

Still, Robinhood hasn’t escaped criticism for participating in a controversial practice called payment for order flow (PFOF). The company receives payments for routing trades to stock trading organizations rather than stock exchanges. The ethical concern here is that these payments demotivate brokers from obtaining the most beneficial trades for their clients.

Public

Meet Public, another trading platform. It’s somewhat similar to Robinhood, as it enables users to buy and sell fractional shares. The application is also free-free, meaning that investors don’t pay any commissions for transactions. The main difference between them is that Public has social features, so that users can start conversations and exchange their trading experience with other investor guys. The company doesn’t violate the interests of investors by practicing PFOF (cough, Robinhood, cough).

Public app functionality

Even though Public doesn’t have a premium account option, it charges clients for returned checks or wire transfers, trades over the phone call involving a broker. Public also accepts optional tips from investors and makes money from interest on cash balances, securities lending, and markup on cryptocurrency trades.

eToro

Another example of a trading app is eToro. It’s a multi-asset platform for investing in crypto that works perfectly well for beginners, who may look more like gamblers rather than investors at the start of their trading journey. It also has social functionality which allows users to watch other more experienced investors and copy their actions.

eToro app functionality

eToro makes profits from the overnight and weekend commissions, the spread it applies on transactions, currency conversion fees, withdrawal commissions, and inactivity fees.

Coinbase

Coinbase is a trading platform that enables users to exchange crypto currencies. Unlike eToro, it doesn’t have any social features, but can boast of intuitive user experience design, which helps a lot with investors who are new to stock trading. The company also generates profits from the spread on the trades. In addition, it charges investors with transaction fees on the debit card and spread when changing to fiat currency.

Coinbase app functionality

How do you solve the problem of financial literacy?

Teaching someone who knows nothing about investing isn’t easy, to say the least. Yet, developing a trading platform with the user-friendly design and educational aspect can work a miracle. A good solution should teach how to create the investment portfolio, achieve long-term financial goals, like saving for retirement, earn dividends, you name it. Your app has to explain each complex financial concept in simple words. You don’t want your clients to close your platform, spend hours Googling each unknown word, trying to figure out the meaning of a sentence, and eventually never come back.

Also, you may be tempted to include as much financial data as possible. But don’t rush to clutter your app with long boring texts and scary numbers – you may ruin all the fun with too much information. Instead, more graphs and charts can make your solution more visually appealing and therefore more comprehensible.

What technology do you need to create a trading platform?

On a technical side, you need to use trading programming interfaces (APIs) to incorporate real-time stock quotes, commodities, indices, and currencies into your app. Most popular APIs right now are Alpaca, DriveWealth, APEX Clearing, and Interactive Brokers.

These companies provide in-depth real-time stock market data as well as a bouquet of functionalities for both mobile and web applications. To be more specific, you can access such features as portfolio management, fractional trading, margin trading, tax reporting, and similar.

With Alpaca and Apex, you can allow your users to trade cryptocurrencies, too. Moreover, each of these APIs ensure support for business accounts and secure multi-factor authentication. Another perk is that there are no limits to which programming language you have to use to build a trading platform.

Why do you need a mobile version of an app?

Given the volatility of the market, investment opportunities are wiped away in the blink of an eye. So, it’s important for a user to keep an eye on the market changes, even when they’re on the go. Therefore, many tend to prefer a mobile version of investment apps.

Moreover, investors who travel a lot or have limited access terminals at their workplaces, may also benefit from using mobile applications. It’s no wonder that Robinhood, a company that focuses on mobile-first approach, has managed to attract more than 22 millions of users. To keep up with such strong competitors, be prepared to invest in building both desktop and mobile apps.

Robinhood mobile app

How much does it cost to build a stock trading app?

Stock trading apps are complex to build, as they usually have multiple third-party APIs. Certainly, this may significantly impact the final price. The cost will also heavily depend upon the trading platform features you’re willing to add. On average, tech startups pay $200,000 for a trading platform.

This sum may be overwhelming, particularly for companies that are tight on budget. That’s why we recommend building a minimum viable product (MVP) first in order to get buy-in from investors. Its development process may take something between three to five months and costs around $15,000-$20,000. Thanks to MVP, you can not only receive financial support for your project but also better understand whether you’re heading in the right direction with your solution.

The future wolves of Wall Street are waiting for your app

If you need technical expertise to build your stock trading solution, you need to turn to a vetted software company that knows how to satisfy the appetite of hungry wolves of Wall Street and also please newcomers as well. JatApp has been delivering FinTech apps for more than seven years now. To date, 99% of clients are satisfied with our work, and most of them continue to cooperate with us for three years on average. If you want to read some of their reviews, you can always visit our Clutch profile for more information.

Need a hand? Don’t hesitate to contact us and we’ll reach out to you as soon as possible.