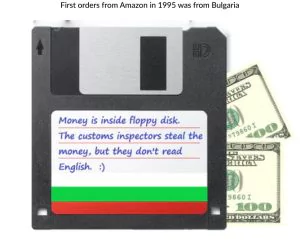

If you’re immersing yourself into the world of e-commerce, payment application programming interface (API) integration is probably the first thing you should think of (when you want to let your customers pay for the goods, of course). Without payment gateways, we would have probably been buying and selling stuff online like back in 1995, when Jeff Bezos received money for one of the first orders inside a floppy disk. And we’re not talking about someone encrypting data on it, like a bitcoin – the customer literally took two hundred dollars bills and crammed them into a little metal door of the floppy disk.

We at JatApp have a rich experience in building payment gateways and can’t wait to share our knowledge with you. After reading this article you’ll understand how a payment gateway works, get familiar with its types, learn how to choose a reliable provider, and maybe even dare to develop your own product (instead of asking your customers to send you money via floppy disks).

But first things first, let’s find out what a payment gateway is.

What is a payment gateway and how does it differ from a payment processor?

Put it very simply, a payment gateway is a solution that allows businesses to securely receive payments for their products and services. Gateways verify customers’ credit card information to authorize a transaction and send it to the payment processor.

At this point, you might wonder: what’s the difference between payment gateway and payment processor? While a payment gateway gathers and checks credit card data, a payment processor connects the merchant, banks, and the credit card company, enabling the transfer of funds.

How does a payment gateway work?

If you think that it’s nothing else but magic happening from the moment a customer adds a product to their shopping cart to the bank approval, we need to assure you that this is just a payment gateway in action. Here’s how it works: a shopping cart is connected to a gateway that asks a user to enter their credit card details. When the user makes a payment by the credit card, the gateway communicates with the card-issuing bank to approve the transaction.

Types of payment gateways

Today, there are different payment gateway integration options, like hosted gateway, non-hosted gateway, and direct post method. Each of these types has its advantages and disadvantages and is suited for different businesses.

Hosted gateway

A hosted gateway is a third-party payment gateway that asks to leave your site to complete a transaction. This means that the client is redirected to a gateway’s own website to enter their credit card number. When the card number is sent, the customer is redirected again to the merchant’s website, where, in the best case scenario, the transaction approval is displayed.

A service provider takes care of all payment processing and stores all the client card information. This is actually good news for you, as this means that you don’t need PCI (payment card industry) compliance. It’s a load off your shoulders, so to speak.

But as anything in life, hosted gateways are not as ideal as you might think. Your clients may not have much trust in third-party payment solutions. Moreover, redirecting customers from your site reduces conversion rates, which is also no good to your business.

Who should choose it: This type of gateway is best suited for small businesses that don’t mind using a third-party payment processor.

Non-hosted gateway

Non-hosted gateway, also known as integrated payment solutions, presuppose that no third party is involved in the checkout process. Businesses that opt for this method obtain PCI compliance, which gives them the ability to store client credit card information and perform initial verifications of transactions. To successfully do this, you would need to install a payment gateway on your site.

Some companies buy non-hosted gateway as a white-label solution. This means that they get a ready-made payment gateway that can be branded and customized as their own technology.

One of the major pros is that once you get a non-hosted gateway, you become a payment service provider yourself. Therefore, you can charge other merchants for processing their payments. Nevertheless, you need to be PCI compliant and manage an infrastructure to securely store client credit data, payment information, and similar stuff.

Who should choose it: An integrated payment gateway is a smart choice for medium and large-sized businesses that focus on user experience and branding.

Direct post method

Direct post refers to an integration method that enables users to shop without ever leaving your site. The transaction information is posted to the gateway, once a consumer presses a buy button. The information is immediately transmitted to the payment gateway and processor, so that your server doesn’t need to store it.

The benefits of the direct post method are similar to the non-hosted payment gateway. You don’t need to obtain PCI compliance and can enjoy a wide variety of customization options. The one thing about the direct post method that bothers us is that it suffers from security issues.

Who should choose it: The direct post fits the companies of all sizes.

What criteria to follow when choosing a payment gateway?

Before deciding on a payment gateway provider, you need to consider multiple factors, ranging from transaction limits to device compatibility.

Transaction limits

Gateway providers set minimum and maximum limits for a transaction. For example, Stripe, one of the most popular payment gateways, has limits from $0.50 to $999,999,99. Notably, most businesses won’t object to such a range. But if companies sell real estate online, for instance, it’s highly unlikely that Stripe would be their best fit. Also, the gateway isn’t well suited for businesses that sell, say, office supplies, where a minimal transaction can be as low as $0.20.

Pricing

Clearly, the price is one of the most important factors that companies consider when going out to select their perfect payment gateway. The one thing to remember here is that the price may depend on multiple factors. The amounts you receive, your business model, and even the types of payments you allow – all these things can make your costs mount up quickly.

A fixed setup fee for new businesses can also be a determining factor whether you’ll go for a solution or not. If you want to cut down expenses, you may want to choose a payment gateway provider with the lowest fee. Some of the providers will also charge you additional fees for not meeting your planned monthly quota. Therefore, you should think twice when building roadmaps of your future growth.

Payment methods

Statista shows that credit cards are the most popular payment method in the world, while PayPal, WeChat Pay, and Alipay take the second place.

The popular payment methods

Since many of your customers will pay with credit cards, you should make sure that your gateway supports multiple credit card networks. It also goes without saying that international companies should choose a gateway that provides multi-currency support.

Device compatibility

Depending on what you’re selling, you’ll have different clientele that use different types of devices. While some gateways work flawlessly on all platforms, some get quite buggy on specific devices. Before you make any commitments, try how the payment gateway works on various operating systems.

Popular payment gateways

When looking for payment gateway API, you may start feeling dizzy from a big choice of different providers. To minimize your dizziness, we decided to come up with a list of the most popular and reliable ones.

Stax

Stax is a gateway platform with fixed monthly and per-transaction fees. The minimum price is $99 per month for organizations with an annual revenue below $500,000. If your company has an income between $500,000 to $1 million, you’ll be charged $199 each month. Meanwhile, a per-transaction fee is only 15 cents.

With this solution, companies don’t have to spend additional money on features they never intend to use. Optional and add-ons packages allow them to pay only for what they really need. Additional functionalities include enhanced dashboards, API key integration, account management, and so on.

Who should choose it: The gateway is best suited for businesses with a monthly revenue more than $5,000.

Stax payment gateway

Stripe

Stripe is famous for its payment processing technology, but it delivers a competitive payment gateway, too. Its solution integrates with your payment system, enabling you to receive online payments from different sources. The company provides a variety of functionalities, including the ability to set up subscriptions, create invoices, and handle international payments. It also has an impressive number of APIs that let you customize your product and meet your unique needs. Stripe charges from 2.7% to 2.9% plus 5 to 30 cents per transaction.

Who should choose it: The gateway is perfect for companies that want to build a custom payment technology.

Stripe payment gateway

Helcim

Helcim is a low-cost payment gateway that provides lots of different features, such as the ability to set up subscriptions, create invoices, and process international payments. If your company needs to handle a large amount of transactions, Helcim will give you a decent discount. As the discount is automatically offered, you won’t need to go through the worst millennials and zoomers’ nightmare – awkward conversations by the phone with the sales team.

It’s worth mentioning that the fees vary greatly, depending on the volume of your transactions. While you pay 0,50% plus 25 cents for processing, say, $25,000, the costs of handling the transaction, which is $5,000, are only 0.20% plus 10 cents.

Who should choose it: the companies that process a great deal of transactions will find Helcim appealing due to its large discounts.

Helcim payment gateway

Let’s take a peek at the comparison table below.

The main difference between these providers is the pricing model. Stax is the most unique, with the fixed monthly fee and low cost per transaction. It’s difficult to compare Helcim to Stripe in terms of per-transaction costs, as the former has so many pricing tiers. However, in most cases, Stripe is a more expensive option than Helcim.

Benefits of building your own payment gateway

Developing a payment gateway should be an informed decision, since the cost for such a project may be literally mind-blowing ($150,000 – $800,000 for a custom solution). The price includes software development, SSL certification, PCI compliance certification, maintenance, administrative costs, and API documentation.

Therefore, such an option is viable only for businesses with large annual revenues. While organizations that have more than one million transactions annually can view the investment in their own gateway technology as worthwhile, merchants with less than $20,000 worth of transactions will simply pour their money down the drain. If you happen to be in the first category, take a look at the benefits associated with a custom payment gateway.

- Customization

Building a payment gateway enables you to add any functionality you want, be it multi-currency transactions or the ability to create invoices. For example, one of our recent clients from the United States needed technical help to create a payment gateway with such custom functionality as a flexible anti-fraud system. This feature allows third-party integrations with different anti-fraud tools that help to increase the overall security of the gateway.

Our client’s payment gateway

- Delivering a payment gateway as a solution

Building your own gateway means that you can sell it to other merchants. Ideally, it could become your recurring source of revenue.

- Lower transaction costs

Investing in your own gateway pays off, especially if you’re a large corporation. In this case, you no longer have to pay a provider per-transaction and monthly fees.

How to develop a custom payment gateway

Developing a custom payment gateway is a complex and multi-step process. If you’re on board with building your own technology, be ready to go through six stages as follows:

- Registering a payment gateway. It’s always a good idea to register with multiple credit card companies.

- Contracting with banks. You’ll need to cooperate with banks, as they will serve as payment processors. Remember that different banks offer different rates for currency exchange.

- Developing an API. At this stage, it’s essential to write comprehensive documentation aligned with PCI compliance.

- Ensuring tokenization. Since you store credit card data, you need to think about such a security measure as tokenization. Tokens will help to protect cardholder data and transaction details from frauds.

- Becoming PCI compliant. At this point you might get tired of hearing about this PCI compliance thing. The matter is that the following measure is an absolute must, unless you want to be scammed by clients who don’t have enough money to make a purchase or use fraudulent data.

- Building an admin panel. Building management tools would let your employees monitor and control merchant’s operations.

Let JatApp help you

If you feel tempted with the perks of building your own payment gateway, here’s some advice on where to start: find a vetted software development company that can offer you solid technical expertise. Partnering with a reliable software agency will reduce the challenges and hurdles associated with building a PCI compliant product.

JatApp has a seven-year experience in developing payment gateways. Our solutions seamlessly handle transactions and offer strong protection from scams. We build our gateways using a microservices architecture. Since each system module acts as an independent micro solution, this approach allows us to update and scale the payment gateway easier and faster.

If you feel that our company services can come in handy, contact us to build your secure payment gateway.